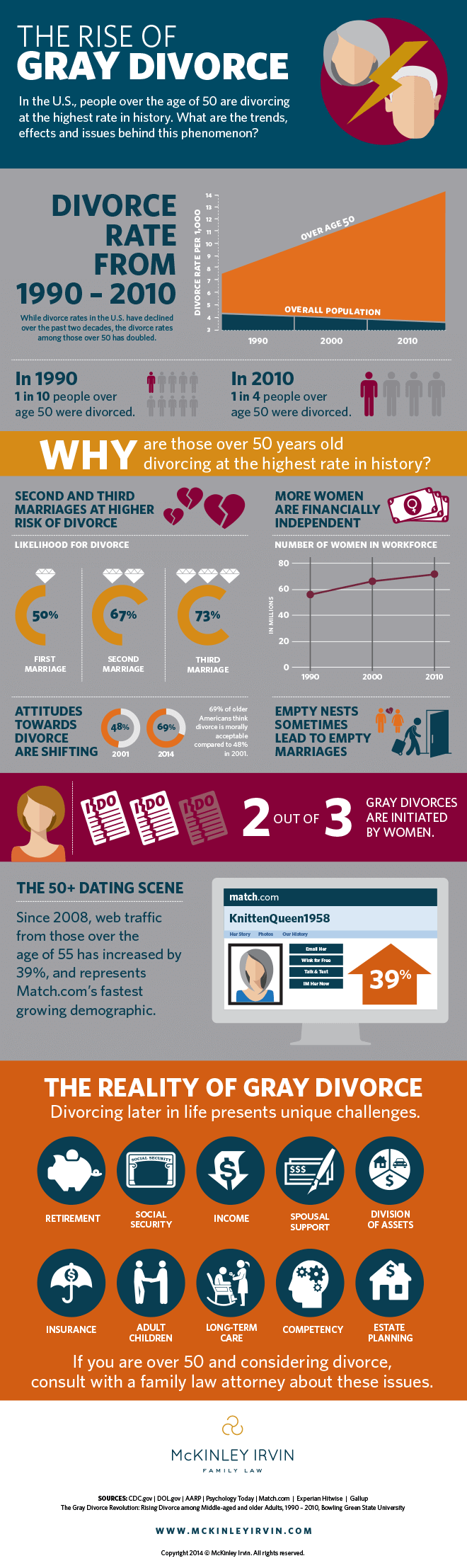

In the U.S., couples over the age of fifty are separating at a higher rate than any other age group. While the divorce rate for younger generations has flattened and even decreased, divorces among baby boomers are increasing. The term to describe this trend is known as gray divorce.

While divorce at any age is difficult, you may face a different set of unique challenges during a late-life divorce.

Financial Planning

The divorce process can be costly and not just in attorney’s fees. The change in household income, and a division of assets, savings accounts, life insurance policies, and property can be stressful when these funds are split between two households. For some, this can lead to a change in economic status, even poverty.

Retirement

Gray divorce can potentially disrupt the couple’s retirement plans since both parties may have to live on half the income they’d expected and planned for. The money a couple has saved throughout their marriage through 401(k) plans, individual retirement accounts, pensions, and other retirement savings plans will more than likely be divided during a divorce through a Qualified Domestic Relations Order, or QDRO. If one spouse received lower or no wages during the marriage they may not receive much in social security during retirement.

Social Security benefits become more important to a spouse that received lower or no wages during the marriage. A divorced spouse, or filing spouse, may be eligible to collect benefits based on the work record of an ex-spouse, or earning spouse only if they meet certain criteria.

Estate Planning

Wills, Powers of Attorney, insurance policies that name the other spouse as the beneficiary or the executor may need to be changed. Check with your attorney whether these changes should be made before or after your divorce.

Long-Term Care

Many married couples live with the assumption their significant other will be there to help support them during their later years in life. However, if you find yourself divorcing after fifty you will need to consider your eligibility for Medicaid and the availability of long-term care insurance.

Get advice

Seek the advice of a divorce attorney that understands the financial implications of divorce in your later years. Having the right information can make all the difference in your quality of life after divorce.

Infographic courtesy of McKinley, Irvin, http://www.mckinleyirvin.com/.

.jpg)