ALIMONY PAYERS LOSE TAX BREAK UNDER NEW TAX BILL

As though divorce and taxes were not confusing enough, you should pay close attention to more than just the changing of your marital status when filing your taxes after a divorce, especially if you are ordered to pay spousal support. With the IRS holding more taxpayers accountable, knowing what is and is not tax-deductible can save you the headache of an audit in the future.

THE GOOD OLD DAYS – CLOSING THE GAP

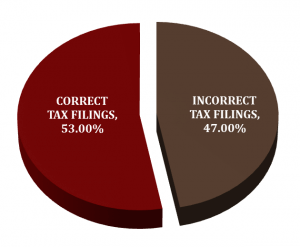

Prior to 2019, alimony payments were deductible by the payer for income tax purposes, while the recipient must claim the payments as income. A recent report by the Treasury Inspector General for Tax Administration (Tigta) revealed that many payers and recipients of alimony were improperly reporting these transactions on their taxes. In Tigta’s analysis, 47% of tax returns showed erroneous reporting of alimony payments, resulting in an estimated $1.7 billion loss in tax revenue over five years.

Although some of the gaps were likely attributable to intentional evasion, another culprit may have been confusion surrounding the tax consequences of paying or receiving alimony, as opposed to child support or property settlements, which are not deductible or treated as income.

THE SOLUTION – HOW THE TAX BILL CHANGED ALIMONY

The new tax law eliminates the deduction for alimony payments for the payer, while the payee no longer has to pay taxes on the payments for divorce agreements executed after December 31, 2018. Whether paying or saving, that can mean big bucks for both parties.

IT’S ALL ABOUT THE NUMBERS

If you are a high-earning spouse, you may want to try and finalize any divorce agreements now.

If you are a high-earning spouse, you may want to try and finalize any divorce agreements now.

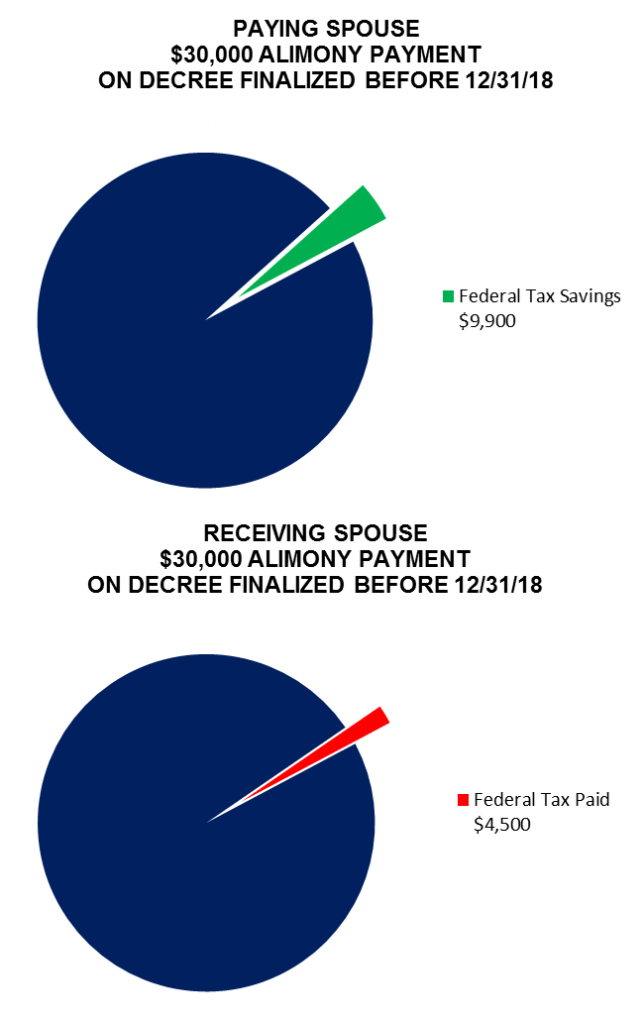

Consider this scenario: Spouse A is ordered to pay $30,000 a year in alimony. The federal income tax rate for Spouse A is 33%. The pre-2019 tax deduction saves Spouse A $9,900.

Spouse B is taxed at only a 15% tax rate, making Spouse B’s payment to the IRS $4,500 rather than the $9,900 that would be paid by Spouse A.

WHAT THE NEW TAX BILL MEANS FOR TEXANS

In Texas, alimony, known as spousal support, is determined based on factors of eligibility. Unless otherwise determined that ongoing support is required, spousal support is limited in the duration under Texas law. (read more on Texas spousal support) Should spousal support be awarded in an agreement post-2018, spouses will be taxed the same as alimony under the new tax law.

Family law attorneys fear the new tax plan will make reaching agreements through mediation, or another form of dispute resolution method, more difficult; making higher-earning spouses more reluctant to agree to make payments.

Though the IRS does not plan to impose automatic e-filing rejections, like those implemented when divorced parents claim an exemption for the same child, alimony rules will remain part of the audit process. We advise a clear discussion with your attorney and tax professional about what classifies as alimony or maintenance and a clear outline in your decree in order to protect you from an unwanted audit.

IMPORTANT DEADLINES

Keep in mind these important filing deadlines if spousal maintenance is a concern. You must have filed for your divorce BEFORE October 31, 2018, and your case must be resolved by either agreement or court order by December 31, 2018.

.jpg)